- Investor's Notebook

- Posts

- Warren Buffett's 2 High-Yield Dividend Stocks for Income Investors

Warren Buffett's 2 High-Yield Dividend Stocks for Income Investors

Warren Buffett's investment strategy is no mystery, especially his fondness for dividend stocks. Berkshire Hathaway's extensive portfolio boasts stocks with impressive dividend histories, with dividends being a consistent feature among its top 12 holdings.

Although Buffett typically favors stocks with reliable dividends over exceptionally high yields, he's made exceptions. In fact, the renowned investor currently holds two ultra-high-yield dividend stocks that present enticing opportunities for income investors.

The Ultra-High-Yield Dividend Stocks

What distinguishes an ultra-high yield from the rest? For Warren Buffett, it's about surpassing four times the yield of the SPDR S&P 500 ETF Trust, currently standing at 1.34%, setting the threshold at 5.36%.

While Berkshire Hathaway's recent filings may not reveal any ultra-high-yield dividend stocks, there's a lesser-known portfolio where Buffett keeps his "secret" stash of high-yield gems.

Back in 1998, Berkshire acquired General Reinsurance, which had previously acquired New England Asset Management (NEAM). NEAM, now a Berkshire subsidiary, manages its distinct investment portfolio. Yet, since NEAM operates under Berkshire's umbrella, any stocks it holds are essentially owned by Buffett and Berkshire.

Within NEAM's portfolio lie several ultra-high-yield dividend stocks, but two in particular catch the eye: Ares Capital, the largest publicly traded business development company (BDC), and Verizon Communications, a global telecommunications giant familiar to most investors.

Click subscribe to Investor’s Notebook newsletter and receive these bonuses for FREE:

Top 5 Fast Growing AI Stocks

Stock Language 101

High Yields, Steady Growth for Income Investors

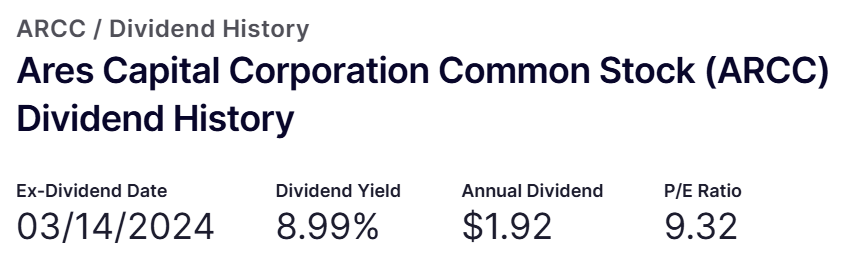

Source: Nasdaq

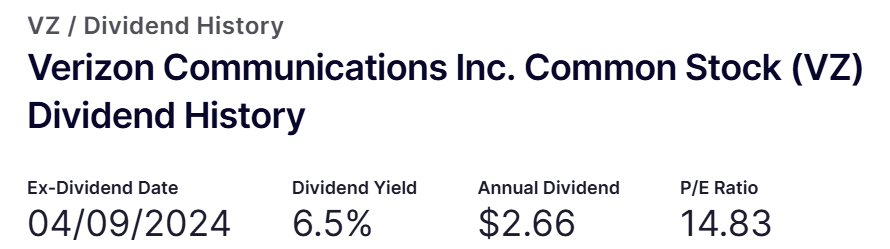

What makes Ares Capital and Verizon stand out as top choices for income investors? Let's delve into their enticing dividend offerings. Ares Capital boasts a forward dividend yield exceeding 8.9%, while Verizon's forward dividend yield sits comfortably above 6.4%.

Beyond their impressive yields, both companies have established themselves as reliable dividend payers. Ares Capital has maintained or increased its dividends for 15 consecutive years, showcasing the highest regular dividend per share growth among large BDCs over the last decade. Similarly, Verizon has a remarkable track record, having raised its dividend payout for 17 years in a row, marking the longest streak in the U.S. telecommunications sector.

Source: Nasdaq

The consistency in dividend payouts reflects the robust business models of Ares and Verizon. Ares dominates the expanding U.S. direct lending market, exercising rigorous selectivity with a mere 5% closing rate on deals. Meanwhile, Verizon leads the way in providing essential wireless and broadband services to both corporate clients and consumers.

Despite the current market climate, characterized by lofty valuations in many sectors, Ares Capital and Verizon offer compelling investment opportunities at attractive price points. Ares boasts a forward price-to-earnings ratio below 9.2, notably lower than the S&P 500 financial sector's multiple of 15.5. Similarly, Verizon's shares trade at just over 9 times forward earnings, a bargain compared to the S&P 500 communication services sector's forward earnings multiple of over 19.2.

Despite their appeal, Ares Capital and Verizon are not immune to risks, as is the case with any investment.

Ares Capital, operating in the lending domain, faces the inherent risk of borrower defaults, particularly during economic downturns. Additionally, the volatility of capital markets poses another layer of uncertainty, independent of the broader economic landscape.

Verizon operates in a fiercely competitive telecom market, requiring substantial investments in cutting-edge technologies like 5G networks. This competitive landscape, coupled with the need for continuous technological advancements, poses challenges to sustained growth, especially during economic contractions.

Nevertheless, both Ares and Verizon maintain promising outlooks for dividend growth and sustainability. For income investors, the reliability of dividend payments remains paramount, underscoring the resilience of these companies in uncertain times.

Want to delve deeper into the world of investing? Subscribe for my FREE newsletter today and gain access to insider tips, expert analysis, and actionable insights to fuel your journey towards financial prosperity.