- Investor's Notebook

- Posts

- Discover the Stock That Turned $10,000 Into $454,000

Discover the Stock That Turned $10,000 Into $454,000

Over the last 20 years, the S&P 500 has shown impressive growth, boasting a total return of 619% as of July 2nd. This means that an initial investment of $10,000 would have grown to approximately $72,000 today—an excellent return by any measure.

However, amidst this broader market success, there's one stock that stands out for its exceptional performance. Interestingly, this company isn't in the realms of internet or artificial intelligence, which might come as a surprise.

This extraordinary stock has achieved an astonishing 4,440% return over the past two decades. That initial $10,000 investment would now be valued at an incredible $454,000. In this blog post, we delve deeper into the story behind this remarkable company and what sets it apart from the rest.

Boring is Beautiful

Investors should take note of O'Reilly Automotive (NASDAQ: ORLY), a seemingly mundane retailer specializing in aftermarket auto parts. Despite its unassuming nature, O'Reilly has delivered impressive returns to its investors over the years, boasting a network of 6,131 stores across the U.S., with additional presence in Canada and Mexico.

Stability in Disruption

One of O'Reilly's strengths lies in its resilience against disruption. Unlike industries facing rapid technological shifts, O'Reilly caters to a large market of vehicles beyond their manufacturer's warranty, which continues to expand with the aging of the vehicle fleet and increasing mileage driven annually. While the rise of electric vehicles poses a potential future risk, the company's current focus remains on leveraging its established market position.

Click subscribe to Investor’s Notebook newsletter and receive these bonuses for FREE:

Top 5 Fast Growing AI Stocks

Stock Language 101

Financial Resilience

O'Reilly's financial performance underscores its stability. The company has maintained steady growth, achieving $15.8 billion in revenue in 2023—a remarkable 66% increase over five years. Even during challenging times such as the pandemic, O'Reilly demonstrated robust double-digit same-store sales growth, showcasing its operational strength.

Profitability and Market Position

With a decade-long average operating margin of 19.8%, O'Reilly consistently generates strong profits. The essential nature of its products affords the company some pricing power, contributing to its profitability in various economic conditions.

A Safe Haven in Volatile Markets

O'Reilly Automotive stands out as a safe haven for investors due to its reliable demand regardless of economic cycles. During economic downturns, consumers prioritize maintaining their existing vehicles rather than purchasing new ones, driving demand for O'Reilly's products. Conversely, during periods of economic prosperity and increased driving, the company benefits from higher vehicle usage.

Looking Ahead

As O'Reilly continues to navigate the evolving automotive landscape, its strategic focus on durable demand and financial stability positions it well for future growth and resilience.

Analyzing Valuation

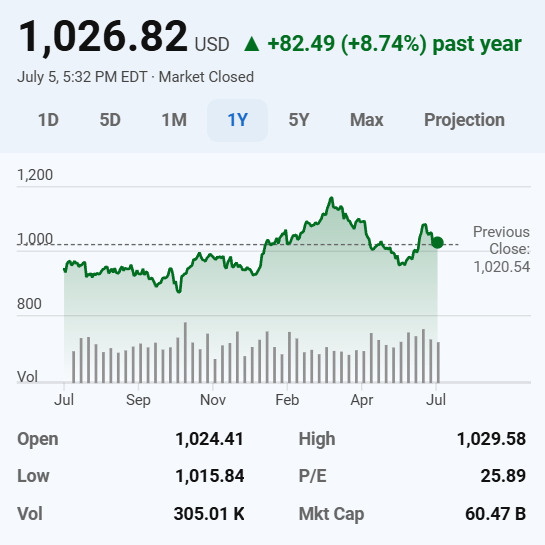

Currently, O'Reilly Automotive (NASDAQ: ORLY) trades at a price-to-earnings (P/E) ratio of 26.3, which appears higher than the S&P 500's P/E ratio of 24.1 and an 11% premium over its own trailing 10-year average. This valuation reflects the market's recognition of O'Reilly's exceptional business performance.

Investment Considerations

Despite the premium valuation, there are compelling reasons to consider investing in O'Reilly. Analyst consensus forecasts project revenue and earnings per share (EPS) to grow at compound annual rates of 6.3% and 10.9%, respectively, from 2023 to 2026. While forward-looking estimates should be approached cautiously, O'Reilly's track record of delivering double-digit earnings growth underscores its potential.

Conclusion

While past performance doesn't guarantee future results, O'Reilly Automotive has consistently proven itself as a compounding powerhouse, rewarding patient investors with superior returns. While the stock may seem fully valued at present, the potential to own a resilient market leader with predictable growth prospects makes it an attractive consideration for long-term investors.

Want to delve deeper into the world of investing? Subscribe for my FREE newsletter today and gain access to insider tips, expert analysis, and actionable insights to fuel your journey towards financial prosperity.