- Investor's Notebook

- Posts

- A 28% Discount: Should You Acquire This Exceptional Dividend Stock with $100

A 28% Discount: Should You Acquire This Exceptional Dividend Stock with $100

Limited Time Offer

28% Discount: Should You Acquire This Exceptional Dividend Stock with $100

In the dynamic realm of investments, few companies offer the perfect blend of growth potential and steady dividends quite like Starbucks Corporation. Today, we uncover why Starbucks emerges as an exceptional dividend stock, boasting a combination of financial strength, growth opportunities, and a commitment to shareholder value. Join us as we explore the compelling reasons to consider Starbucks for your investment portfolio.

Understanding Starbucks

Starbucks needs no introduction – it's a global powerhouse in the coffee industry, renowned for its premium offerings and unparalleled customer experience. As of 2023, there were a whopping 38,038 Starbucks stores worldwide, including various segments owned by the coffee-chain, such as Siren Retail. This impressive number underscores Starbucks' widespread presence and dominance in the market, offering investors unparalleled exposure to a global consumer base.

Robust Financial Performance

In the fourth quarter of fiscal 2023, Starbucks showcased stellar financial performance:

Consolidated Net Revenues surged by an impressive 11% to hit a record high of $9.4 billion.

Global comparable store sales increased by 8%, driven by:

A 4% increase in average purchase value.

A 3% rise in comparable transactions.

North America and the U.S. saw an 8% uptick in comparable store sales:

Fueled by a substantial 6% boost in average purchase value.

Accompanied by a 2% rise in comparable transactions.

Internationally, comparable store sales rose by 5%, with China leading the charge:

A 5% growth driven by an 8% increase in comparable transactions.

Despite a slight 3% dip in average purchase value.

Starbucks expanded its global footprint by opening 816 net new stores, totaling 38,038 stores worldwide—52% company-operated and 48% licensed.

The Starbucks Rewards loyalty program experienced significant growth, with 90-day active members in the U.S. reaching 32.6 million, marking a substantial 14% increase year-over-year.

For the entire fiscal year 2023, Starbucks sustained its momentum with an 8% increase in global comparable store sales, driven by a 5% rise in average purchase value and accompanied by a 3% increase in comparable transactions. Notably, North America and the U.S. experienced exceptional 9% growth, underscoring the company’s robust performance in its primary market. Additionally, the international market (excluding China) also delivered stellar performance, further solidifying Starbucks’ position as a global leader in the coffee industry.

Click subscribe to Investor’s Notebook newsletter and receive these bonuses for FREE:

Top 5 Fast Growing AI Stocks

Stock Language 101

Dividend Growth

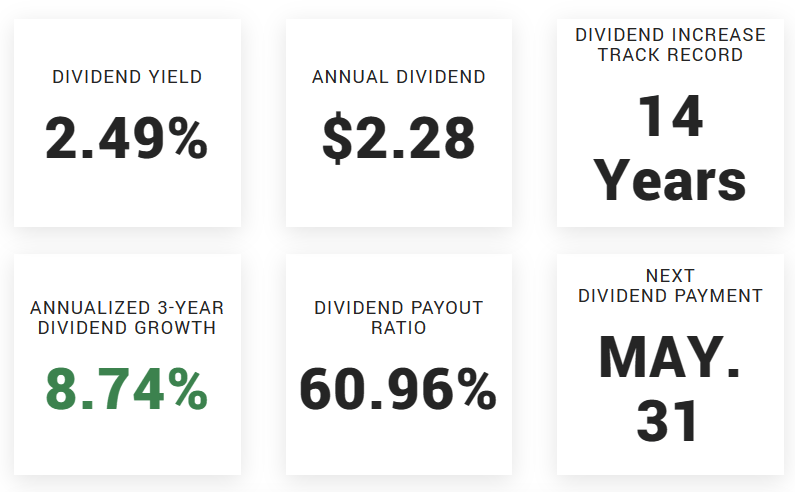

Starbucks' Dividend Growth. Data: Marketbeat

For income-oriented investors, Starbucks' commitment to increasing dividends is a compelling draw. The company has a consistent track record of raising its dividend payout, with a dividend growth rate of approximately 20% annually over the past five years. Starbucks' current dividend yield stands at 2.49%, with an annual dividend of $2.28 per share. Additionally, Starbucks has consistently increased its dividend for the past 14 consecutive years, with an annualized 3-year dividend growth rate of 8.74%. This track record reflects the company’s commitment to rewarding shareholders and signifies steady and positive growth in dividend payments.

Expansion Initiatives

Beyond its dividend prowess, Starbucks continues to fuel growth through strategic expansion efforts. While the United States boasts the highest number of Starbucks locations (with over 16,000 stores in 2023), the company’s international presence has been growing significantly. In fact, for the first time in 2018, there were more international Starbucks stores than in the U.S., and this gap has continued to widen. This expansion, coupled with the surge in Starbucks Rewards loyalty program memberships, underscores Starbucks' relentless pursuit of growth and customer engagement.

Risks and Mitigation

While Starbucks faces risks inherent to its industry, including competition and economic volatility, the company's proactive risk management measures mitigate these concerns. Starbucks' relentless focus on customer engagement, product innovation, and operational efficiency strengthens its competitive position and resilience in the face of challenges, minimizing downside risks for investors.

Investment Thesis

In summary, Starbucks stands out as an intriguing investment opportunity, boasting a blend of dividend income, growth potential, and resilience. Its strong financial performance, consistent dividend increases, and expansion efforts make a compelling case for long-term investors in search of stability and potential growth. Considering the additional of Starbucks to your investment portfolio allows you to enjoy the advantages of reliable dividends while also being part of the growth trajectory of a global icon.

Conclusion

As you set off on your investment journey, keep an eye on companies like Starbucks - those that embody resilience, innovation, and shareholder value. Whether you’re a seasoned investor or new to the market, Starbucks offers a glimpse into enduring success that withstands market shifts and economic uncertainties. Take note of this iconic brand and its potential for long-term wealth creation. And remember, if you ever crave a caffeine fix, Starbucks is just around the corner - those unmistakable green mermaid signs will guide you to them!

Want to delve deeper into the world of investing? Subscribe for my FREE newsletter today and gain access to insider tips, expert analysis, and actionable insights to fuel your journey towards financial prosperity.